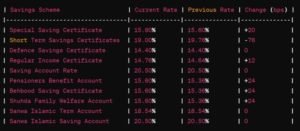

National Savings Schemes profit rates revised in Pakistan. National Savings in Pakistan has recently announced revisions to the profit rates of various national savings schemes.

These changes encompass adjustments of up to 24 basis points (bps) across different schemes, aiming to reflect evolving economic conditions and investor needs.

National Savings Schemes profit rates revised

Key Changes:

1. Special Saving Certificate (SSC): The profit rate for SSC has been elevated by 20 basis points, now standing at 15.8 percent. This adjustment is in line with efforts to provide more attractive returns to investors.

2. Savings Accounts (SA): Savings Accounts continue to offer a stable profit rate of 20.5 percent, maintaining consistency amidst the revised rates of other schemes.

3. Short Term Savings Certificate (STSC): In contrast, the profit rate for STSC has witnessed a decline of 76 basis points, settling at 19 percent. This adjustment reflects market dynamics and the need for flexibility in interest rates.

4. Bahbood Savings Certificate (BSC), Pensioner’s Benefit Account (PBA), and Shuhada Family Welfare Account (SFWA): These schemes have seen an increase of 24 basis points in their profit rates, now offering returns at 15.6 percent. This move aims to incentivize investment in these avenues.

5. Defense Savings Certificate (DSC), Savings Accounts for Special Persons (SITA), and Savings Accounts for Senior Citizens (SISA): The profit rates for these schemes remain unchanged, with DSC holding at 14.4 percent, SITA at 18.54 percent, and SISA at 20.5 percent. Stability in these rates ensures continued confidence among specific investor segments.

Implications:

These revisions in profit rates underscore the responsiveness of National Savings to economic fluctuations and investor preferences.

By adjusting rates across various schemes, National Savings aims to balance competitiveness with financial sustainability, catering to the diverse needs of investors in Pakistan’s financial landscape.