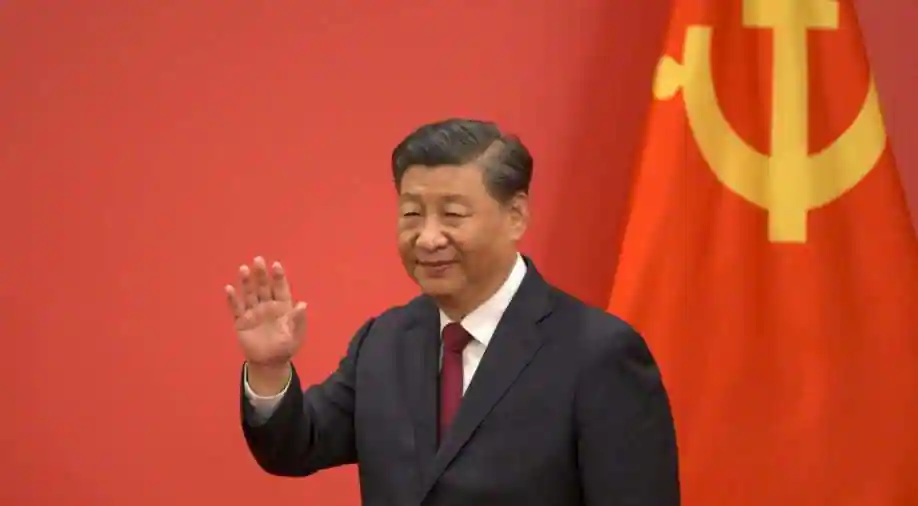

Beijing is experiencing severe economic stress as a result of the real estate crisis and the zero-Covid policy, which has a significant impact on its manufacturing units. This is happening as Chinese leader Xi Jinping begins his third term as general secretary of the Chinese Communist Party (CCP).

According to an Atlantic Council article by Niels Graham, an assistant director at the GeoEconomics Center, the decisions he makes during this third term could potentially cause the Chinese economy to shrink by up to $5 trillion over the following five years, which could have disastrous consequences for global economic growth.

He now finds himself in a very different economic climate than when he first assumed his position ten years ago. In 2012, when Xi took over as president of China, the country had recently found wealth and was expanding quickly. Over the span of Xi’s first two terms, the Chinese economy nearly doubled in size, growing at a rate of about 7% annually on average.

The situation has significantly changed since then. Graham predicted that China will fail its annual GDP growth objective for the first time since 1989. According to the Atlantic Council, Beijing cites the extensive COVID-19 restrictions it has imposed nationwide as the official reason for the slowdown.

However, a slowdown in growth before the pandemic began and economic crises like a collapse in the real estate market, troubled local government finances, and an increase in youth unemployment indicate that the slowdown may have deeper causes.

As concerns about China’s economic performance grow, new research from the Rhodium Group’s China Pathfinder and the Atlantic Council Geo-economics Center examines whether the growth slowdown is actually a brief blip brought on by Beijing’s pandemic response or a sign that China is diverging from market thinking.

The data, which covers the development of the financial system, market competition, trade openness, steps toward a modern innovation system, direct-investment openness, and portfolio openness, and spans the years 2010 to 2021, demonstrates that China’s economy has unmistakably converged with open market economy norms, even though the progress has been uneven.