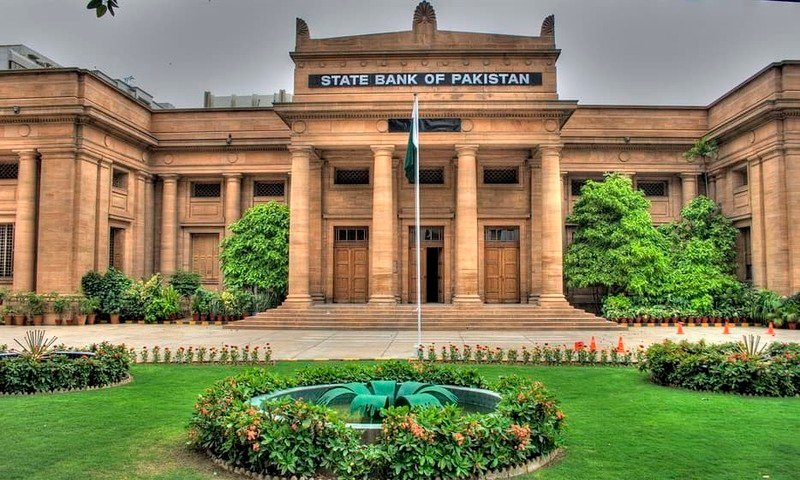

The State Bank of Pakistan filed a case in the Supreme Court on Saturday, disputing the ruling of the Federal Shariat Court (FSC) against interest.

Respondents in the case include the finance ministry, the law ministry, the chairman of the banking council, and others.

The bank requested that the appeal against the FSC judgement be granted and that the scope of the points raised in the judgement be modified.

Salman Akram Raja filed the petition on behalf of the State Bank.

According to the central bank’s appeal, the Shariat Court did not consider the injunctions of the Supreme Court Remand Order when issuing its judgement.

The Islamic court ruled that the saving certificates were un-Islamic, according to the petition, and the FSC ordered that the rules be changed.

On April 28, the Federal Shariat Court ordered the establishment of a Riba-free banking system in the country in accordance with Islamic teachings, declaring that the prohibition of Riba (interest) was absolute in all its forms and manifestations according to Islamic injunctions and the Holy Quran and Sunnah. As a result, it should be eradicated from the country by December 31, 2027.

The FSC declared the Interest Act of 1839, the West Pakistan Money Laundering Act, and other interest-related laws to be against Islamic Shariah and ordered the government not to borrow any loan on interest from within or outside the country from now on.

In its judgement, the FSC stated that it was obligatory on the government to eliminate ‘interest-bearing’ loan borrowing. “We must eliminate the system at any costs.” “Islamic banking is risk-free and the polar opposite of the exploitative system,” said the ruling.

The FSC bench declared that developing a Riba-free banking system in the country and around the world is feasible.

The decision came after the case had been pending for 20 years.