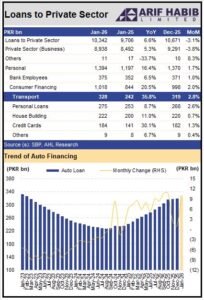

Auto financing in Pakistan continued its upward momentum in January 2026, reaching Rs. 328 billion, compared to Rs. 242 billion in January 2025, according to data compiled by Arif Habib Limited, citing figures from the State Bank of Pakistan.

This reflects a year-on-year growth of 35.8 percent, highlighting a sustained recovery in consumer auto loans after a prolonged slowdown.

Month-on-Month Growth Signals Continued Demand

On a month-on-month basis, auto financing increased by 2.8 percent compared to December 2025, indicating steady consumer demand for vehicle financing and growing confidence among buyers.

Industry observers say the consistent monthly increase suggests that Pakistan’s auto financing sector is gradually stabilizing after being impacted by record-high interest rates over the past two years.

Auto Loans Recovering After High Interest Rate Slowdown

The January 2026 figures show that car financing volumes are steadily climbing toward earlier peak levels, following a sharp contraction during the period of elevated borrowing costs.

With interest rates easing, consumers are increasingly returning to auto financing, helping revive loan growth across banks and financial institutions.

Lower Interest Rates Fuel Auto Financing Growth

According to industry analysts, the primary driver behind the rise in auto financing is the relatively favorable interest rate environment. Reduced borrowing costs have made car loans more affordable, encouraging both first-time buyers and replacement demand.

Banks have also contributed by offering:

-

Lower markup rates

-

Flexible repayment plans

-

Improved loan approval processes

These measures have played a key role in boosting loan uptake across the market.

Demand Driven by Small and Fuel-Efficient Cars

Demand for smaller, fuel-efficient vehicles continues to dominate Pakistan’s auto financing landscape. Entry-level cars and used imported vehicles remain particularly popular in a price-sensitive market, where buyers prioritize affordability and fuel economy.

This shift in consumer preference has helped sustain financing growth despite broader economic challenges.

Auto Financing Still Below 2023 Peak Levels

Despite the recovery, auto financing remains below its historical peak of approximately Rs. 368 billion, recorded in mid-2023.

Analysts note that several structural constraints continue to limit faster expansion, including:

-

Loan caps imposed by banks

-

Higher down payment requirements

-

Shorter loan tenures

These factors have moderated the pace of growth, even as demand gradually improves.

Outlook for Auto Financing in Pakistan

Market experts expect moderate but steady growth in Pakistan’s auto financing sector over the coming months, provided interest rates remain stable and economic conditions continue to improve.

The sector’s performance will remain closely tied to monetary policy decisions, vehicle prices, and consumer purchasing power.