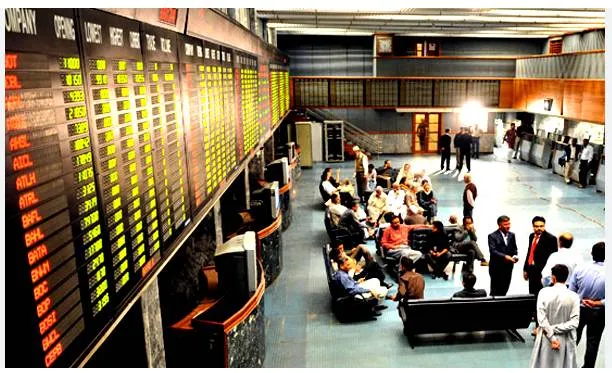

The Pakistan Stock Exchange (PSX) continued its bullish momentum on Monday as the benchmark KSE-100 Index crossed the 190,000 mark for the first time in history, driven by strong buying ahead of the State Bank of Pakistan (SBP) Monetary Policy Committee (MPC) meeting.

During early trading hours, the index was hovering at 190,455.44, up 1,288.62 points, or 0.68%. Out of 563 listed companies, 218 shares gained, 163 declined, and 182 remained unchanged.

Sector-Wise Buying Interest Boosts Market

Analysts observed buying interest across key sectors, including automobile assemblers, cement, fertilisers, oil and gas exploration companies (E&P), oil marketing companies (OMCs), and power generation & refineries. Large-cap stocks such as ARL, HUBCO, MARI, OGDC, FFC, HBL, and MCB traded in positive territory, supporting the index rally.

The PSX had also set a record on Friday, closing at 189,166.83 points, up 1,478.67 points, or 0.79%, as renewed investor interest picked up momentum.

SBP MPC Meeting: Interest Rate Decision in Focus

The Monetary Policy Committee is scheduled to meet at 10:30 am under the chairmanship of the SBP Governor to decide the key policy rate, which will remain in effect for the next two months.

The committee will assess multiple economic indicators, including imports, exports, large-scale manufacturing, trade and fiscal deficits, remittances, foreign exchange reserves, crop production, and global oil prices.

Market analysts are expecting further monetary easing, with predictions of a policy rate cut of 50 to 100 basis points (bps) to stimulate economic activity.

Economic Outlook: GDP Growth and IMF Targets

Despite the stock market rally, Pakistan is unlikely to meet the International Monetary Fund (IMF)’s projected 3.2% GDP growth for the current fiscal year, as exports and investments continue to weaken, analysts noted.

Investors are closely watching today’s MPC decision, with expectations that a favourable policy rate cut could further propel the PSX and boost confidence in key sectors.