Gold and silver prices surged to fresh record levels on Monday after US President Donald Trump threatened to impose new tariffs on European countries, triggering renewed concerns over global trade stability and economic uncertainty.

Investors moved into safe-haven assets, pushing precious metals sharply higher during early trading.

Gold Touches All-Time High in Spot and Futures Markets

Spot gold climbed to an all-time high of $4,689.39 per ounce earlier in the session before easing slightly to around $4,666 per ounce.

Meanwhile, US gold futures for February rose 1.7% to $4,671.40 per ounce, reflecting strong demand from institutional and retail investors seeking protection against geopolitical risk and potential inflation pressures.

Trade Dispute Concerns Drive Market Uncertainty

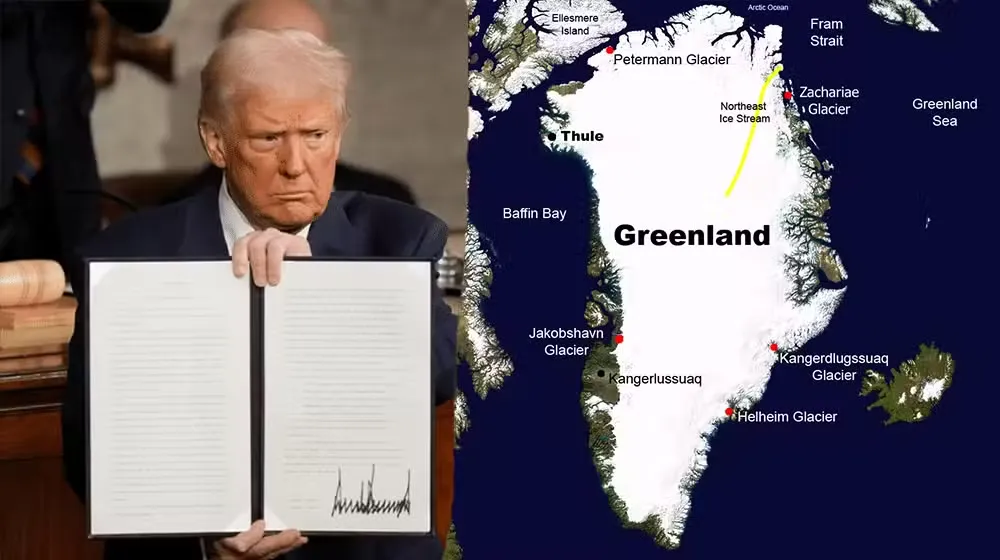

Over the weekend, President Trump warned that the United States could impose escalating tariffs on European allies unless the US is allowed to purchase Greenland, according to international media reports.

In response, EU ambassadors are reportedly preparing retaliatory measures should the proposed tariffs be implemented, raising fears of a broader trade confrontation between the US and Europe.

Silver Records Stronger Gains Than Gold

Silver prices outperformed gold during the session, supported by a combination of industrial demand, supply constraints, and safe-haven buying.

-

Spot silver jumped nearly 4% to $93.50 per ounce

-

Prices earlier reached a record high of $94.08 per ounce

Analysts cautioned that the rapid pace of gains could increase short-term market volatility, especially if profit-taking begins after the sharp rally.

Other Precious Metals Also Edge Higher

Other metals posted moderate gains as well:

-

Platinum rose 1.1% to $2,353.25 per ounce

-

Palladium increased 0.2% to $1,804.06 per ounce

While demand for these metals remains linked to industrial activity, broader investor sentiment toward commodities improved amid heightened geopolitical risks.