KARACHI: The central bank of Pakistan is scheduled to meet today (Monday) to announce its key policy rate for the next six weeks in order to maintain a balance between inflation and economic growth.

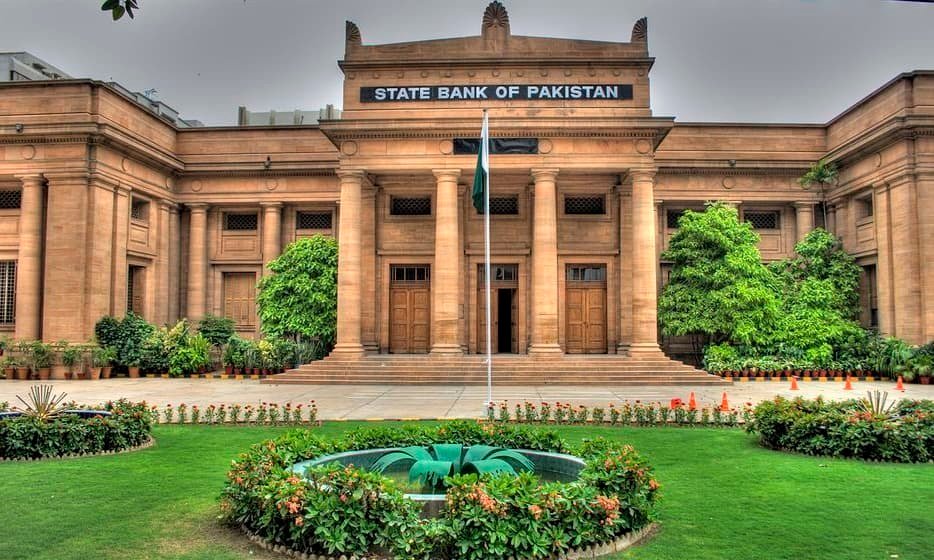

To ensure external and price stability, the State Bank of Pakistan (SBP) unexpectedly increased its benchmark interest rate by 250 basis points (bps) to 12.25 percent on April 7.

Since September 2021, the SBP has cumulatively increased the rate by 525 basis points to control inflation and reduce the current account deficit.

The Monetary Policy Committee (MPC) will convene for the first time under acting governor Dr Murtaza Syed to make decisions regarding the key policy rate.

Market rumours point to a 100 basis point (bps) increase, which would take the rate to 13.25%, as the central bank looks forward to countering a high inflation reading and likely surge in energy prices to pave the way for reviving the stalled multibillion-dollar International Monetary Fund (IMF) programme.

As a result of uncertainties at the global, regional, and domestic levels of the political and economic arenas, a portion of experts believes that the monetary policy decision may not be as predictable as anticipated this time around.

In a report, a Topline Securities analyst stated, “In light of rising inflation and a weakening currency, we expect the SBP to raise the policy rate by 100 basis points.”

“Since the last Monetary Policy Statement (MPS) in April, secondary market rates, such as T-Bill/KIBOR rates, have increased by approximately 200 basis points due to uncertainty regarding the removal of subsidies on gasoline and diesel and the continuation of the IMF programme.”

Treasury bills cut-off yields declined for the first time in nearly a year at the most recent auction held on May 19, declining by 5-29 basis points, with three, six, and twelve-month T-Bill yields registering at 14.49 percent, 14.70 percent, and 14.75 percent, respectively.

Topline Research conducted a survey of prominent fund managers to gauge their outlook on the nation’s economic future.

According to the survey results, approximately 54% of respondents anticipated an increase of 100bps, 14% anticipated an increase of 150bps, and 11% anticipated an increase of 200bps or more.

In contrast, only 13% of participants anticipate a 50bps increase, while 9% anticipate no change.

The depletion of foreign exchange reserves, the escalation of the fiscal deficit as a result of massive gasoline and diesel subsidies, and the indecision of the new government regarding key economic measures are aggravating Pakistan’s current economic difficulties.

“It will be crucial for the government to take the necessary reform steps, such as removing subsidies on gasoline and diesel, limiting imports, and enhancing tax collection. This will pave the way for the resumption of the IMF programme, which is currently stalled and will lead to dollar flows that could reduce pressure on the currency and foreign exchange reserves in the future, as noted by the analyst.

Inflation is likely to rise further over the next few months. In the last two months, the rupee has lost nearly 10 percent against the US dollar, surpassing the 200 thresholds last week. With a less-than-two-month import cover and delays in the IMF bailout, the rupee is under significant pressure.

The weakening rupee and record-high fiscal slippages are likely to increase consumer price index (CPI) inflation to 15-16 percent, creating a compelling case for a rate hike of at least 100 basis points.